🔊 You can also listen to this article in audio format

Perfect for listening during your commute or while working. Just press play below to hear the full article.

Trump’s Statement Sends a Signal to the Market

“No Intent to Dismiss Powell” Calms Market Concerns

On April 22, 2025, U.S. President Donald Trump stated that he has “no intention of dismissing Federal Reserve Chair Jerome Powell.” This remark, made during a press interaction at the White House, immediately alleviated fears about political interference in monetary policy—an issue that had been weighing heavily on global markets.

Over recent weeks, Trump had ramped up pressure on the Fed to cut interest rates and had hinted at Powell’s possible removal. Investors, already wary due to renewed U.S.–China trade tensions, were rattled by what seemed to be another round of executive overreach.

Fed Independence: A Key Institutional Pillar

The independence of the Federal Reserve is considered a cornerstone of credible monetary policy. Historical episodes—such as the politically influenced decisions under President Nixon—highlight the economic damage that can result from blurred boundaries between politics and central banking.

Trump’s explicit denial of any dismissal intent restored confidence, particularly among institutional investors. The easing of term premium pressures and the restoration of policy credibility encouraged a wave of risk-on sentiment across major asset classes.

Foreign Exchange Markets React with a Sharp Yen Depreciation

USD/JPY Surges to 143: Reversal Fueled by Position Unwinding

In early Asian trading on April 23, the yen plunged, with USD/JPY briefly touching 143.02, marking a sharp ¥2.7 depreciation from the prior day’s close.

This abrupt move was driven by several factors: the reversal of safe-haven flows, a broad recovery in U.S. equities, and aggressive short-covering of USD positions by speculative funds. The unwinding of excessive bearish dollar bets (particularly from CTAs and hedge funds) provided the catalyst for this momentum-driven reversal.

Structural Drivers of Yen Weakness Remain Intact

Japan’s near-zero real interest rates contrast starkly with the Fed’s relatively high policy rates, continuing to drive USD strength in yield-differentiated flows. With political uncertainty around the Fed dissipating, this interest-rate divergence reasserted itself as the dominant factor in FX pricing.

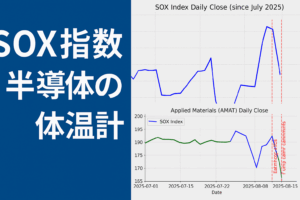

U.S. Equities Rebound Strongly, Japan Seen Following

Dow Gains Over 1,000 Points, Nasdaq Rallies 2.7%

Bloomberg reported that U.S. Treasury Secretary Scott Bessent described the U.S.–China tariff standoff as “unsustainable” and hinted at the potential for eventual resolution. This dovish narrative, coupled with Trump’s Powell comments, ignited a rally.

The Dow Jones Industrial Average closed up 1,016 points (+2.66%), and the Nasdaq Composite rose 2.7%, ending a five-day losing streak.

Japanese Market Optimism Builds, But is Still Futures-Based

While Japan’s cash equity market was not yet open at the time of reporting, Nikkei 225 futures (June contracts) surged in overnight trading, closing at 34,820 (+540 points).

Despite this positive momentum, actual price action in the Tokyo Stock Exchange will depend on investor response to both global sentiment and corporate earnings—especially with Q4 FY2024 earnings season underway.

Fed Policy Outlook: Relief for Now, But Caution Ahead

Political Pressure Temporarily Cools

Trump’s denial temporarily relieves concerns of politicized monetary policy. For fixed-income and currency markets, this marks a de-escalation of short-term tail risks.

However, with the 2025 presidential election looming, renewed political interference remains a latent risk, and markets are unlikely to lower their guard entirely.

Fed Policy Path and USD Outlook

CME FedWatch data shows that the probability of a June rate cut remains around 30%, reflecting a cautious stance by the Fed. Barring inflationary surprises, real yields are likely to remain elevated—supporting the dollar.

Conclusion: Key Takeaways for Investors

- Trump’s assurance on Powell’s tenure removed a key tail risk from markets.

- USD/JPY surged as speculators unwound bearish bets, reigniting yield-driven FX flows.

- U.S. equities rebounded, and Japanese futures indicate optimism—but actual cash trading remains to be seen.

- Investors should watch for the April 24 U.S.–Japan Finance Minister Meeting, as currency concerns may resurface.